Are you a business owner, entrepreneur, or someone simply curious about businesses in the Lone Star State?

If you need to find information about a Texas-based Limited Liability Company (LLC), you’re in the right place.

In this blog post, we’ll guide you through the simple process of looking up LLCs in Texas and explore the types of valuable information you can discover.

Why Look Up LLCs in Texas?

There are several reasons why you might want to find information on an LLC in Texas:

- Verification: Is the company you’re dealing with legitimate and legally registered in Texas?

- Research: Learn more about a competitor, potential partner, or investment opportunity.

- Due diligence: Conduct necessary research before engaging in a business relationship.

- Legal matters: Gather information for potential lawsuits or legal proceedings.

Does Texas recognize LLC?

Absolutely! Texas does recognize Limited Liability Companies (LLCs) as a legitimate business structure. Here’s why:

- Legal Basis: LLCs are formally established under the Texas Business Organizations Code. This code sets the rules and regulations regarding the formation, operation, and governance of LLCs within the state.

- Official Registration: The Secretary of State of Texas oversees the filing and registration process for LLCs. When you form an LLC in Texas, you must file a Certificate of Formation with the Secretary of State.

- Benefits of LLCs in Texas: LLCs are a popular business structure in Texas because they offer:

- Limited Liability: LLC owners (members) are generally shielded from personal liability for the debts and obligations of the business.

- Tax Flexibility: LLCs have the option to be taxed as partnerships or corporations, offering greater flexibility compared to some other business structures.

- Management Options: LLCs can be managed by their members or by appointed managers, increasing adaptability to different business needs.

Where to Find Texas LLC Information

The Texas Secretary of State is the official source for business entity information in the state.

Here are two primary ways to access LLC records:

1. Texas Secretary of State Website

- Go to the Texas Secretary of State website (https://www.sos.state.tx.us/)

- Navigate to the “Business and Public Filings” section.

- Click on “SOSDirect” to access the online search tool.

- Search using one of the following methods:

- Business Name: If you know the LLC’s name. Note that name availability rules, such as requiring business type suffixes (e.g., “LLC”), apply.

- File Number: A unique identifier assigned by the Secretary of State.

- Taxpayer Number: A company’s Tax ID can help pinpoint their official records.

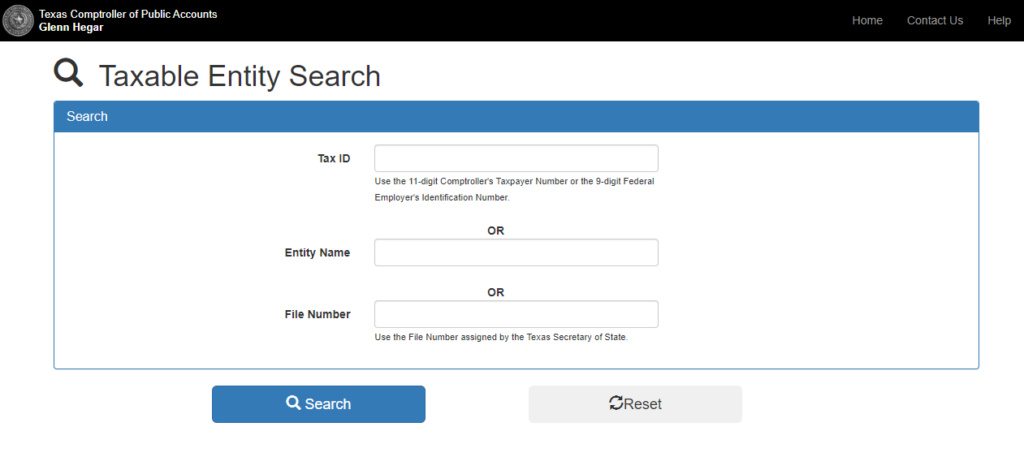

2. Texas Comptroller of Public Accounts Website

- Visit the Texas Comptroller of Public Accounts website (https://mycpa.cpa.state.tx.us/coa/)

- Use the “Taxable Entity Search” tool.

- Search by taxpayer number, business name, or file number.

What Information Can You Find?

Here’s what you can usually discover by looking up an LLC in Texas:

- Filing Status: Is the LLC active, inactive, or forfeited (if its right to do business in Texas has been revoked)?

- Formation Date: The establishment date of the LLC.

- Registered Agent and Office: The LLC’s official contact person and address for receiving legal documents.

- Members or Managers: Names of the LLC’s owners (members) or those in charge (managers).

- Franchise Tax Status: Information on whether the LLC is in good standing with the Texas Comptroller.

Important Considerations

- Search Accuracy: Ensure you’re using the correct spelling of the LLC’s name for accurate results.

- Limited Information: You may not always have access to complete ownership or financial information of private LLCs.

- Additional Resources: For more in-depth research, consider exploring third-party resources or paid business information databases.

Additional Tips

- Specific Requirements: If you intend to search for LLCs relating to a legal proceeding, confirm any specific requirements regarding certified records that may be needed.

- Document Ordering: Both the Secretary of State and Comptroller websites allow you to order certified copies of documents for a fee, which may be useful for official purposes.

- Trademark Research: If you’re thinking of adopting a similar business name, check business name availability using the SOSDirect service and potentially with the US Patent and Trademark Office (USPTO).

Do I need a business license in Texas for an LLC?

The short answer is: it depends.

Here’s a breakdown to help you determine if your LLC needs a business license in Texas:

No General State Business License

Texas does not have a general statewide business license that all LLCs must obtain simply to operate.

Potential Licensing Requirements

However, there are two primary areas where specific licenses or permits might be required for your LLC:

- Occupational Licenses: Texas regulates numerous professions and trades. If your LLC’s activities fall within a regulated field (e.g., accountants, plumbers, electricians, real estate agents, etc.), your business will likely need a professional or occupational license from the relevant state licensing board.

- Local Licenses and Permits: Cities, counties, and other local municipalities within Texas may impose their own licensing requirements depending on the nature of your business and its location. Examples include health permits for restaurants, vendor licenses for festivals, and various special permits.

Other Considerations

- Sales and Use Tax Permit: Nearly all businesses selling goods or certain services in Texas must obtain a sales and use tax permit from the Texas Comptroller of Public Accounts. This is often misconstrued as a business license but relates specifically to sales tax collection.

How to Find Out What You Need

- Texas Economic Development & Tourism Website: Start at https://gov.texas.gov/business/page/start-a-business, which provides helpful guides and resources.

- Texas Department of Licensing and Regulation (TDLR): Check their website (https://www.tdlr.texas.gov/) for information on any occupational licenses your industry might require.

- Local Government: Contact your city or county government offices to inquire about any local permits or licenses needed for your type of business and location.

Important Note: Licensing requirements can be complex and can change over time. It’s always best to consult with a business attorney or accountant specializing in Texas law to ensure full compliance for your LLC.

How much does it cost to start an LLC in Texas?

Here’s a breakdown of the costs involved in starting an LLC in Texas:

Mandatory Filing Fee

- Certificate of Formation: The Secretary of State charges a $300 filing fee to form your LLC. This is the unavoidable primary cost.

Potential Additional Costs

- Expedited Filing: If you need your LLC formed quickly, expedited filing options are available but carry additional fees.

- Registered Agent: An LLC in Texas must designate a registered agent (an individual or entity with a physical address in Texas) to receive official legal documents. You can act as your own registered agent, or hire a registered agent service (costs typically range from $50-$300+ per year).

- Certified Copies: If you need official certified copies of your Certificate of Formation for banks, investors, or other purposes, these carry an additional fee per document.

- Legal or Accounting Professionals: While not strictly required, many people engage an attorney or accountant to assist with the LLC formation process. This will obviously incur additional expenses.

Ongoing Costs

- Franchise Tax: Most Texas LLCs will be subject to a franchise tax, determined by your business revenue. It can be complex to calculate, so the Texas Comptroller provides information and guides (https://comptroller.texas.gov/taxes/franchise/)

- Annual Reports: LLCs in Texas are generally not required to file annual reports or renewal fees. This saves money compared to some other states.

Important Considerations

- Budgeting: While the mandatory $300 filing fee is the key number, make sure to budget accordingly for any other expenses you might choose to incur (like a registered agent or expedited filing).

- Sales Tax: If selling goods or certain services, factor in the costs related to a Sales and Use Tax Permit with the Texas Comptroller.

Final Thoughts

Looking up LLCs in Texas is a straightforward process that can provide valuable insights for a variety of business and legal needs.

Did you know that you can easily stay updated on the business landscape in Texas?

The Texas Secretary of State and the Comptroller of Public Accounts have got your back!

They offer some amazing resources that you can use to stay informed.

Read also: How to Start an Online Business in Texas: 5 Step Guide