Starting a business in Dallas, Texas can be an exciting endeavour, but also requires careful planning and preparation.

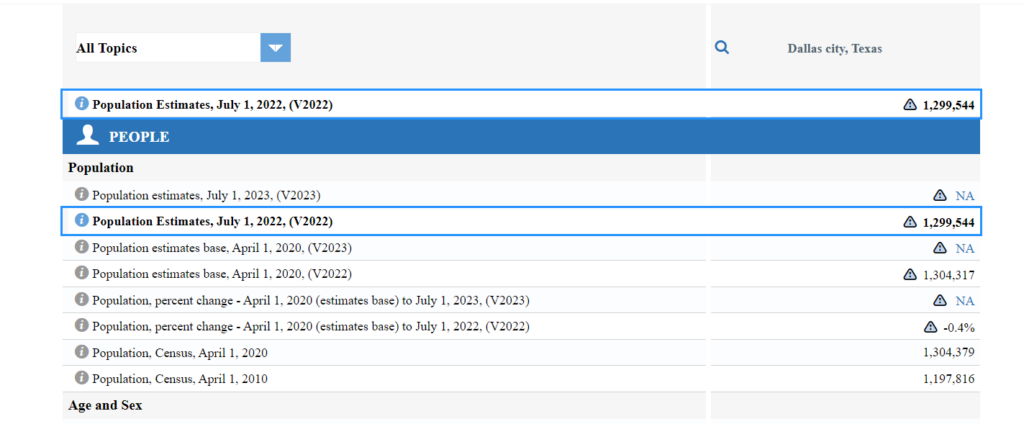

With a population of over 1.3 million and a strong economy, Dallas offers great opportunities for entrepreneurs. Here are some key steps to get your business up and running in Dallas:

- Research your business idea – Make sure there is a need for your product or service. Analyze the competition and target market.

- Choose a business structure – Will you be a sole proprietorship, partnership, corporation, LLC? Consider liability, taxes, and regulations.

- Register your business – File paperwork with the TX Secretary of State and register for taxes. Obtain licenses and permits.

- Find a location – Look for office space or retail location. Consider lease terms, foot traffic, parking, accessibility.

- Get business insurance – Liability and property insurance protect you from risk. Workers comp covers employees.

- Finance your business – Explore funding options like loans, investors, crowdfunding. Develop financial projections.

- Hire employees – Post jobs, interview, run background checks. Set up payroll. Comply with labor laws.

With proper planning and a passion for your work, Dallas can be a prime location to start and grow your business.

Starting a business in Texas checklist

Here is a helpful checklist of steps to take when starting a business in Texas:

Choose a business structure

- Sole proprietorship, partnership, LLC, corporation, etc. Consider liability protection, taxes, paperwork.

Register your business

- File formation documents with TX Secretary of State based on business structure.

Obtain an EIN from the IRS

- Apply for free Employer Identification Number even if you have no employees. Used for taxes and banking.

Register for state and local taxes

- Set up to collect/remit sales tax, payroll taxes, etc. Requires permits/accounts.

Check zoning regulations

- Ensure your business type and location comply with local zoning laws.

Apply for licenses and permits

- Acquire any required state and city licenses for your industry. Renew annually.

Set up business banking account

- Open dedicated business bank account and credit card. Keep finances separate.

Get business insurance

- Purchase necessary policies like general liability, property, workers’ comp, etc.

Set up accounting system

- Use software like QuickBooks to manage income, expenses, taxes, payroll.

Understand legal obligations

- Research regulations like labor laws, safety, discrimination, accessibility, etc.

Register domain name and build website

- Set up professional website and integrate email, social media, SEO.

Promote your business

- Create marketing plan to advertise services, attract ideal customers.

Hire any necessary employees

- Write job descriptions, interview, perform background checks, onboard staff.

This covers major steps when starting a Texas business. Work with lawyers and accountants to ensure full legal compliance and success. Modify checklist based on your specific business needs.

Crafting a Business Plan

One of the most important steps when starting a business in Dallas is developing a comprehensive business plan.

This document will serve as your roadmap and help you secure funding and other support. Here are key elements to include:

Executive Summary – High level overview of your company, products/services, mission, and growth plans.

Company Description – Legal business structure, history, location, staff, growth potential.

Market Analysis – Research your industry, target customers, competitors, pricing, sales/marketing strategy.

Organization & Management – How you are legally structured and managed. Include leadership bios.

Products & Services – Details about your offerings. Include features, pricing, competitive advantage.

Financial Plan – Past financials if applicable, projected profit/loss, cash flow, expenses, sales forecasts.

Funding Request – If seeking investors or loans, include amount needed and planned use.

Appendix – Supporting documents like licenses, permits, owner resumes, market research data.

Creating a comprehensive plan shows funders you have conducted due diligence and have a viable path to profitability.

It also requires you to thoroughly think through all aspects of your business.

Be sure to outline:

- Specific goals and timeframes

- Your unique value proposition

- Realistic financial projections

- Target customers and how you’ll reach them

- Your competitive edge

The plan should be reviewed and updated regularly as your business grows and evolves.

With a solid business plan in place, you’ll be off to a strong start in Dallas.

Choosing a Business Location

Selecting the right location is a key decision when starting your business in Dallas. Carefully consider these factors when choosing where to set up shop:

Access and Visibility – Find a spot with high foot traffic or drive-by visibility to attract new customers. Being on a main thoroughfare or near a busy area is ideal. Easy parking and access are also important.

Competitor Proximity – Study where competitors and similar businesses are situated. Being too close may oversaturate the area while being too far makes you less convenient.

Zoning Regulations – Confirm zoning allows for your type of business. Food service may require a permit, industrial may have safety rules. Know the regulations.

Lease Terms – Negotiate lease length, rent price per square foot, rate increases, maintenance fees, utilities. Get favorable terms.

Growth Potential – Ensure there is room to expand onsite or to move to a larger space nearby. Don’t limit future growth.

Costs – Budget for rent, renovations, utilities, insurance and other costs. Factor in these expenses.

Target Audience – Your location should make sense for your target demographic. A family eatery should be residential, IT firm downtown.

Suppliers & Resources – If reliant on frequent deliveries or local resources, be near these suppliers. Manufacturers need transport access.

Infrastructure – Ensure access to reliable utilities like electricity, water, internet. Manufacturing may require industrial zoned utilities.

Security – Your neighborhood should be safe for both customers and employees. Well-lit parking, alarm systems and other security are a must.

Best locations to start a business in Dallas, Texas

The best locations to start a business in Dallas, Texas, include the following:

Frisco

Frisco is ranked as the best city in Texas to open a new business. It has a strong business culture, a healthy local economy, and various programs designed to stimulate the economy. Frisco excelled in categories such as median house prices, population growth, and the number of residents with a Bachelor’s degree.

Farmers Branch

This Dallas suburb is ranked as one of the best small cities in Texas for starting a business. It scored well in the business environment category and is considered a business-friendly location.

Fort Worth

While not in Dallas, Fort Worth is also a top location to start a business, leading the list of the best places to start a business in Texas. It offers a favorable business environment, abundant resources, and competitive costs.

Arlington

Arlington is another city in the Dallas-Fort Worth area that ranks well for starting a business, landing at No. 19 on the list of best places to start a business in Texas.

Dallas

Dallas itself is a good location to start a business, with a robust and comprehensive incentive system to support businesses. It is also ranked as the No. 8 best metropolitan area to start a small business in the U.S.

These rankings are based on factors such as business environment, access to resources, business costs, and the overall strength in supporting entrepreneurship and business in the region.

Taking the time to find the ideal location will pay off in the long run with more customers, higher staff retention, and reduced costs.

Consider a commercial real estate agent to help identify the perfect business location in Dallas.

Don’t commit until the space meets your accessibility, visibility, expansion and infrastructure needs.

Financing Your Dallas Business

Sufficient capital is essential when starting a Dallas business. Explore these financing options to fund your entrepreneurial endeavor:

Personal Funds – Tap into your savings or personal assets like home equity. Requires no debt repayment. You retain full control.

Friends & Family – Ask friends/family to invest. Set clear repayment terms. Benefits relationships, but risks straining them.

Business Loans – Banks offer small business loans and lines of credit. Require good credit, collateral, and detailed application.

SBA Loans – Government-backed Small Business Administration loans help high risk ventures. Longer terms and lower down payments.

Equipment Financing – Fund specific equipment purchases through financing companies. Pay over time. Conserve capital.

Business Credit Cards – Rewards cards with 0% intro APR help manage expenses. Avoid high interest rate cards long-term.

Crowdfunding – Platforms like Kickstarter or GoFundMe let you raise funds from backers. Useful for new consumer products.

Angel Investors – Wealthy individuals invest in startups for equity. Experienced angels provide expertise.

Venture Capital – VC firms offer significant funding in exchange for partial company ownership. Very selective.

Business Incubators – Some organizations assist new startups with space, mentoring, and access to investors.

Small Business Grants – Government and private grants support women, minority, veteran, and other underserved groups.

Supplier Credit – Ask suppliers for better credit terms to help cash flow. Pay 30-60 days after delivery.

Customer Financing – Offer payment plans to customers to increase sales. Check customer creditworthiness.

When seeking financing, be sure to have a solid business plan, financial history, and projections.

Shop multiple lenders for the best terms and avoid predatory lenders.

Seek expert legal and tax advice when structuring financing deals. With the right funding mix, your Dallas venture can successfully get off the ground.

How much does it cost to start a business in Texas?

Here are some of the key costs to consider when starting a business in Texas:

- Business filing fees – To formally register your business in Texas, you’ll need to file formation documents with the Secretary of State. Fees start at around $300 for a basic LLC and go up based on business structure.

- Permits and licenses – Most businesses require state and local permits and licenses that involve fees, such as sales tax permit, food handler permit, liquor license, etc. These vary based on location and business type, but plan for a few hundred dollars.

- Office space – If you need commercial space to operate, leasing costs will be a major expense. Average commercial lease rates in Texas run $15-$20 per square foot monthly. Even a small 800 sq ft space would cost over $1,000 per month.

- Renovations – Tenant improvements like flooring, walls, lighting could cost $20-$100 per square foot if the space needs significant work. Budget several thousand for smaller spaces.

- Utilities – Expect to pay monthly bills for electricity, gas, water, internet, phone, garbage pickup. These can easily total over $1000 a month or more depending on your usage.

- Insurance – Texas businesses typically need general liability, commercial property, and workers’ compensation insurance. Premiums vary based on risk level but budget $1,500-5,000 annually.

- Employees – Employee salaries, taxes, and benefits like health insurance are a major ongoing expense. Budget at least $25,000 per employee annually.

- Inventory – Product-based businesses have significant upfront inventory costs, which can easily be tens of thousands of dollars.

- Marketing – Promoting your new business takes advertising dollars for activities like website development, signage, print ads, online marketing. Budget $2,500-5,000 when launching.

- Professional fees – Lawyers and accountants cost $200-$500 per hour. Expect to pay at least a few thousand handling business formation, agreements, tax setup, and ongoing compliance.

All in, starting a new business in Texas often costs at least $50,000-100,000 or more depending on the type and size of the operation. Significant startup capital is required.

Hiring Employees in Dallas

Assembling a skilled team is key to succeeding as a new Dallas business. Follow these tips when hiring your first employees:

Determine Roles – Carefully plan staffing needs in advance. Outline roles, responsibilities, skills required, and salary budget.

Job Descriptions – Write detailed descriptions that profile ideal candidates. Include role, duties, requirements, pay, and benefits.

Recruiting – Post openings on your website, job boards, social media, and local publications. Attend job fairs and contact schools.

Screen Resumes – Review qualifications and experience to identify top applicants. Perform phone screens to verify skills.

Interview Questions – Prepare a list of questions that assess hard and soft skills. Ask behavior-based questions. Take notes.

Background Checks – Conduct criminal, credit, and reference checks to avoid potential issues. Review social media also.

Assessments – Have candidates complete skills assessments like typing tests, writing samples, simulation exercises.

Reference Checks – Speak to a candidate’s past managers and coworkers to learn work style, strengths and weaknesses.

Salary & Benefits – Offer fair pay and quality benefits like insurance, retirement plans, paid time off to attract talent.

Employment Agreements – Have new hires sign offer letters or contracts detailing pay, rules, termination terms.

Onboarding & Training – Set up equipment, accounts, training manuals. Do extensive training to get new hires productive.

Probation Periods – Set an initial 90-120 day probation to continue evaluating new staff. Extend those not meeting expectations.

Legal Compliance – Comply with state/federal labor laws including minimum wage, anti-discrimination and leave policies.

With the right personnel in place, your Dallas startup will be equipped for success.

Remember to be patient and take time to find the perfect additions to your team. The investment in talent acquisition will pay off exponentially.

Marketing & Promoting Your Business

Gaining visibility and attracting new customers takes smart marketing. Use these strategies to successfully promote your new Dallas business:

Create a Brand Identity – Design an eye-catching logo, tagline, and style guide. Ensure visual coherence across platforms. Register trademarks.

Launch a Website – Hire a designer to build an intuitive site that engages visitors. Include services, products, company info, blog. Optimize for SEO.

Social Media Profiles – Create business pages on Facebook, Instagram, Twitter, and LinkedIn. Share content, run ads, and interact with followers.

Local SEO – Optimize online listings on Google, Facebook, Apple Maps. Ensure accurate NAP and responsive Google My Business profile.

Email Marketing – Collect emails to build subscriber list. Send promotions, newsletters, special offers to loyal customers.

Network Locally – Join Chambers, biz groups, associations to meet local business leaders. Sponsor community events.

Email Signatures – Add branded signature with link to your site in all employee emails. Easy free advertising.

Print Marketing – Distribute flyers, postcards, brochures at local shops, networking events, conferences, tradeshows.

Advertise – Buy ad space in local papers, blogs, magazines. Advertise on billboards, radio, local TV. Participate in local business directories.

Press Releases – Distribute releases about new products, services, staff, achievements. Pitch relevant story ideas to media.

Grand Opening Event – Host a launch party for the community when you open. Give tours, free samples, gifts, deals.

Coupons/Discounts – Offer seasonal or limited time discounts and perks for customers through various channels.

Reviews – Ask happy customers to leave positive reviews on Google, Yelp, Facebook, and industry forums. Resolve negative feedback quickly.

Referral Programs – Offer existing customers incentives for referrals. This powerful word-of-mouth stimulates organic growth.

With creative grassroots marketing and consistency, your Dallas business can build meaningful mindshare and loyal local customers over time.

Steps to register a business in Dallas, Texas

Before your business is operational, you need to register.

Here are the general steps to register a business in Dallas, Texas:

1. Choose a Business Structure

Decide on the legal structure for your business, such as a sole proprietorship, LLC, corporation, etc.

Each structure has different legal and tax implications.

Resources like the Texas Secretary of State website can help you choose the right one: https://www.sos.state.tx.us/corp/businessstructure.shtml

2. Obtain a Federal Employer Identification Number (EIN)

Apply for an EIN from the IRS, even for sole proprietorships.

This number is crucial for opening business bank accounts, hiring employees, and filing taxes.

You can file online or by mail: https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

3. Register Your Business Name

If your business operates under a name different from your legal name, file an Assumed Name Certificate (Doing Business As) with the Dallas County Clerk’s office.

You can do this online, by mail, or in person: https://www.dallascounty.org/government/county-clerk/recording/assumed-names/assumed-names-procedures.php

4. Register with the State of Texas

Depending on your chosen business structure, you may need to file formation documents with the Texas Secretary of State.

This process varies depending on the structure, but you can file online through SOSDirect: https://www.sos.state.tx.us/corp/sosda/index.shtml

5. Obtain Necessary Licenses and Permits

Research and obtain any licenses and permits required for your specific industry and location.

This information can be found on the City of Dallas website or by contacting the appropriate regulatory agency. Here are some helpful resources:

- City of Dallas Business Resources: https://dallascityhall.com/business/pages/default.aspx

- Dallas County: https://www.dallascounty.org/

- State of Texas Business Permits and Licenses: https://gov.texas.gov/business/page/business-permits-office

6. Open a Business Bank Account

Separate your personal and business finances by opening a dedicated bank account for your business.

Your EIN will be needed for this.

7. Register for Texas Sales Tax (if applicable)

If your business sells taxable goods or services, register for a Texas Sales Tax permit with the Texas Comptroller of Public Accounts: https://comptroller.texas.gov/help/sales-tax-registration/requirements.php/

Additional Tips:

- Consider seeking professional legal and accounting advice to ensure compliance and navigate specific complexities.

- The City of Dallas Office of Economic Development and SCORE Dallas offer resources and support for small businesses:

- Dallas Office of Economic Development: https://www.dallasecodev.org/

- SCORE Dallas: https://www.score.org/dallas/content/dallas-mentors

- Remember, these are general steps, and specific requirements may vary depending on your unique business model.

How can a foreigner start a business in Texas?

Starting a business in Texas as a foreigner involves additional considerations compared to a local resident. Here’s a breakdown of the key steps and resources:

1. Determine Eligibility:

- Visa Status: Ensure your visa allows business ownership. Some visas, like tourist visas, restrict business activities. Research visa requirements with the U.S. Department of State: https://travel.state.gov/content/travel/en/us-visas.html

- Business Structure: Choose a structure like LLC or corporation. Consider tax implications and professional advice. The Texas Secretary of State website offers guidance: https://www.sos.state.tx.us/corp/businessstructure.shtml

2. Register Your Business:

- Foreign Entity Registration: If operating in Texas, foreign entities need to register with the Texas Secretary of State, even for online-based businesses. Fees apply. More information here: https://www.sos.state.tx.us/corp/foreignfaqs.shtml

- Federal Employer Identification Number (EIN): Apply for an EIN from the IRS even if you have no employees. This number is crucial for business operations and taxes.

3. Licenses and Permits:

Research and obtain any licenses and permits specific to your industry and location. The Texas Comptroller of Public Accounts and City of Dallas websites offer resources:

- Texas Comptroller of Public Accounts: https://comptroller.texas.gov/

- City of Dallas Business Resources: https://dallascityhall.com/business/pages/default.aspx

4. Banking and Taxes:

Open a dedicated business bank account in the U.S. You’ll need your EIN for this.

Understand your tax obligations based on your visa status and business structure. Consider seeking professional tax advice.

Additional Resources:

- U.S. Small Business Administration (SBA): Offers resources and assistance for starting and running a business: https://www.sba.gov/

- SCORE Dallas: Provides free business mentoring and workshops: https://www.score.org/dallas/content/dallas-mentors

- Dallas Office of Economic Development: Offers resources and support for new businesses: https://www.dallasecodev.org/

Remember:

This is a general overview, and specific requirements may vary based on your visa type, business model, and industry.

Consult with immigration attorneys, accountants, and business advisors for personalized guidance and ensure compliance with all legal and tax obligations.

Key Takeaways

- Conduct in-depth research on your industry, competitors, and target demographics in the Dallas market

- Create a well-developed business plan outlining your strategy and financial projections

- Select a location in Dallas that matches your budget and business needs

- Secure start-up financing through savings, loans, investors or other sources

- Build a skilled team by writing job descriptions, posting openings, interviewing, on-boarding staff

- Promote your business in Dallas through online presence, local networking, advertising and grand opening event

- Continuously refine your offerings, marketing and operations to adapt to the Dallas market

Read also: 25 Hottest Small Business Ideas in Dallas and How to Launch Them